Inheritance tax rates in Germany are consistent across the whole country They apply to savings property and. What are the inheritance tax thresholds in Germany for 2017-2018 The beneficiaries of the inheritance are taxed according to their taxable class. The following tax rates have been applicable to inheritance tax and gifting tax since 1 January 2010 Value of assets less exempt amount ofTax class ITax. Depending on the value of the estate and the relationship between the heirs and the deceased inheritance taxes may. Your guide to German inheritance tax By N26 Love your bank Related posts Tax exemption order what it is and why you need one 8 min read What is the..

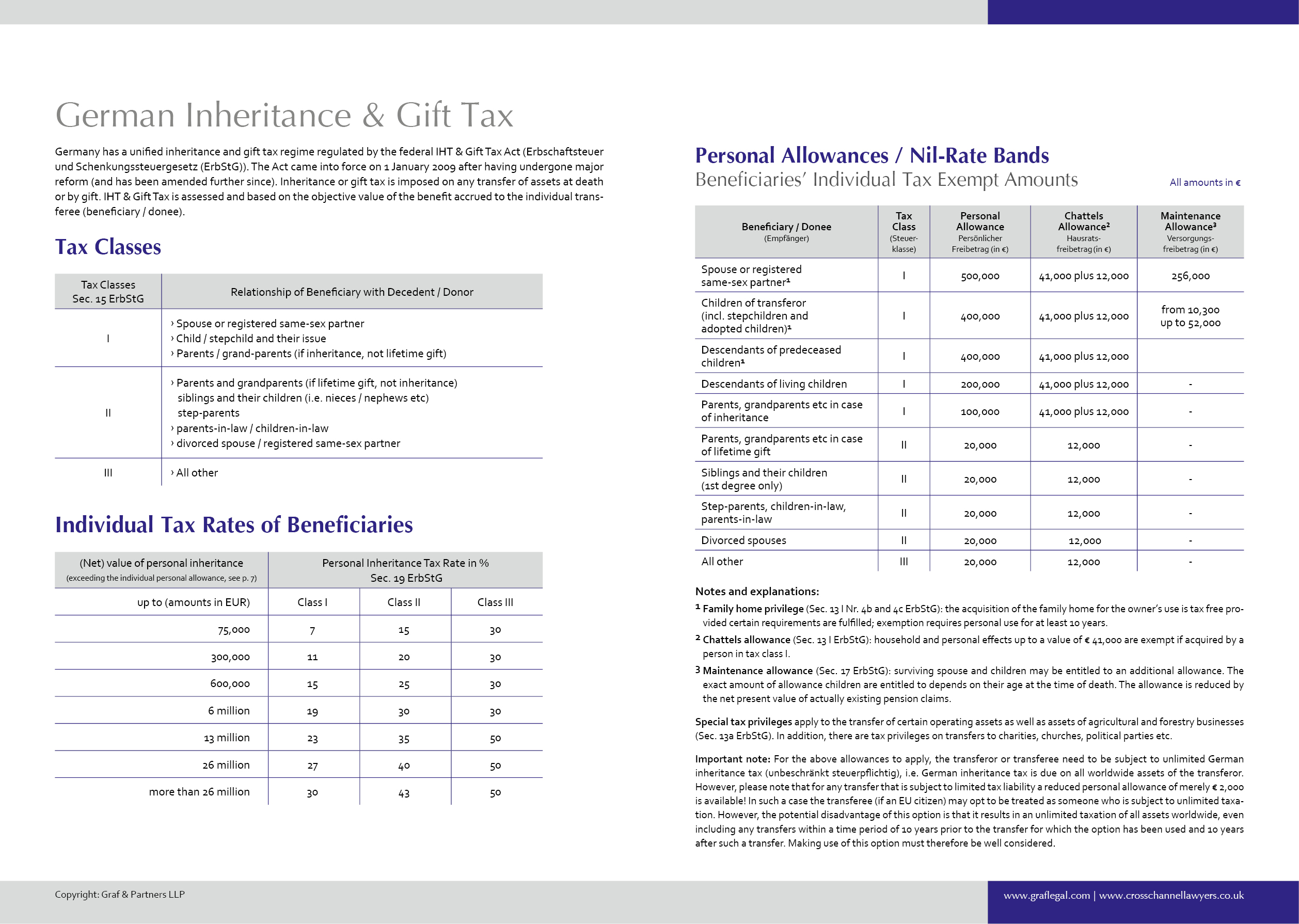

German Inheritance Tax Rates And Personal Tax Exempt Amounts Cross Channel Lawyers

Story by Ben Riley-Smith 44m Markets today INX 042 DJI 043 COMP 054 Rishi Sunak and Jeremy Hunt considered an inheritance tax cut for the Autumn Statement -. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022 The exemption amount would therefore be. Reports suggest that Chancellor Jeremy Hunt is more likely to cut the rate at which inheritance is charged - from 40 to something lower Again there is no confirmation of. This tactic is known as the step-up in basis at death Biden proposes ending this basis step-up for gains in excess of 1 million for single taxpayers 25 million for couples. How to avoid inheritance tax If you live in a state that imposes inheritance taxes there are a few ways to minimize the bill on handed-down assets Getting help from a qualified tax expert..

Beginning January 1 2011 estates of. Starting in 2023 individuals can transfer up to 1292 million to heirs during life or at death. Nuray Bulbul November 20 2023 at 431 AM 5 min read Jeremy Hunt has faced pressure from some. Kentucky and New Jersey have the highest rate at 16 Iowa is phasing out its inheritance tax and by..

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

Peter Walker Aletha Adu Downing Street has pushed back against renewed speculation that ministers are thinking about scrapping inheritance. Some 4 of families pay inheritance tax - 27000 in the 202021 tax year That would cost the Treasury the least at. Inheritance tax is charged on the part of someones estate above the tax-free threshold which is 325000 That can rise to 500000 if a home is. Govt considers scrapping of IHT in early 2024 The government is considering axing inheritance tax in three months time to boost chances of a. Who would benefit from inheritance tax cuts After that you should pay a tax rate of 20 on what you get for anything up to 500000..

Comments